MX™ Advantage App

MX™ Advantage is a business solution that provides merchants a one-stop shop for Fee-based processing.

-

What is a surcharge?

An additional fee that a merchant adds to a customer's bill when a credit card is used for payment. -

What is MX™ Advantage for Surcharging?

MX™ Advantage for Surcharging is an integrated MX™ app that provides merchants with a compliant solution for applying a payment card surcharge. -

When can surcharges apply?

Surcharging is limited to credit cards only (no surcharging debit and prepaid cards) -

Is there a limit to how much a merchant can surcharge?

In no event can a merchant assess a surcharge above 3% of the base amount, even in cases where the applicable merchant discount rate exceeds 3% of the underlying transaction amount. Information provided here is subject to Visa’s operating regulations relating to surcharging. Additionally, the merchant cannot assess a surcharge that is higher than their cost of card processing. -

Is surcharging allowed in all states?

States prohibiting or limiting surcharging as of September 2020 are: Colorado, Connecticut, Kansas, and Massachusetts -

Is registration required?

Merchants must notify their sales representative/Priority at least 30 days in advance of beginning to surcharge. Alternatively, if you wish for Priority to handle this process, the Sales Representative must email [email protected] and Priority will initiate the registration process. -

Does the surcharge need to be disclosed?

YES.

Face-to-Face Transaction: The merchant must disclose the surcharge as a merchant fee and, for both in-store and online transactions, clearly alert consumers to the practice at the point of entry, the point of sale or transaction, and on every receipt. Signage is included with the merchant’s welcome kit.

Telephone order Transaction: Merchant must provide verbal notification of the surcharge and surcharge amount before the sale is completed.

Electronic Commerce Transaction: At the point of entry (catalog, web page, etc.), the first page of the catalog that references card brands is accepted, and the Checkout page. -

Will the merchant receive signage to display?

Yes, merchants receive necessary signage in their welcome kit and additional signage may be ordered. -

Can I surcharge on one card brand but not all?

No. The fee set in MX™Connect for MX™ Advantage for Surcharging applies to all card brands. -

How do I process a refund when a surcharge is applied to the sale?

- When processing a refund through Quick Pay, enter the full refund amount including the amount of the surcharge you’d like to return to the cardholder. The surcharge will not be entered for you.

- When processing a refund through “Payments”, choose “Refund” and then the full amount will display including the surcharge amount. The amount may be edited if desired.

-

ls MX™ Advantage for Surcharging available on the TSYS and First Data platform?

No. MX™ Advantage for Surcharging is currently only available on the TSYS platform. -

Does MX™ Advantage for Surcharging only work with the MX™ Front End?

Yes, the merchant must process on the MX™ Gateway. Merchants may apply a surcharge using any MX™ products. Merchants who wish to surcharge must settle through TSYS.

- MX™ Quick Pay

- MX™ Invoice

- MX™ Payment Links

- MX™ QuickBooks Sync

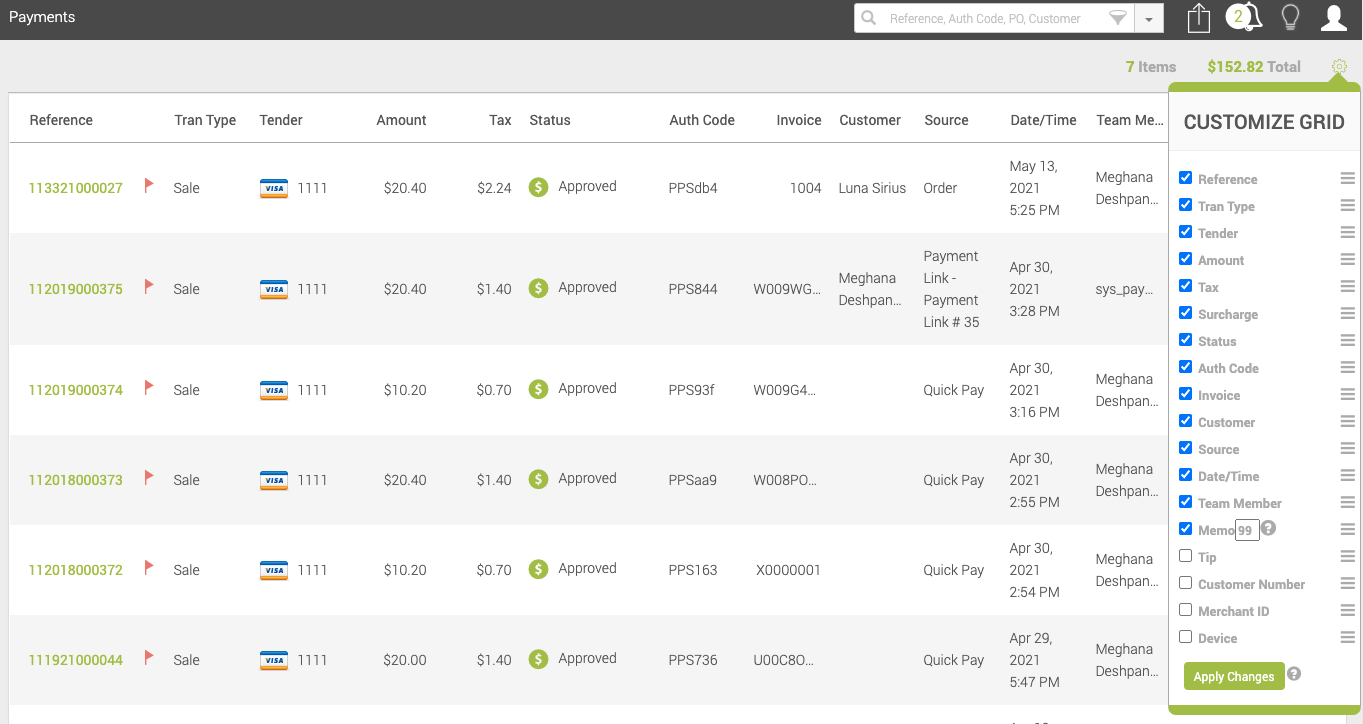

- Where can I see the Surcharge applied to the payment after the payment is processed?

The Surcharge amount can be viewed on the Payments grid.

- Click on Settings on the Payments grid

- Select the “Surcharge” field

- Drag and drop to rearrange it on the grid.

-

How do I activate MX™ Advantage for Surcharging?

Contact your Sales Representative to begin surcharging with MX™ Advantage. -

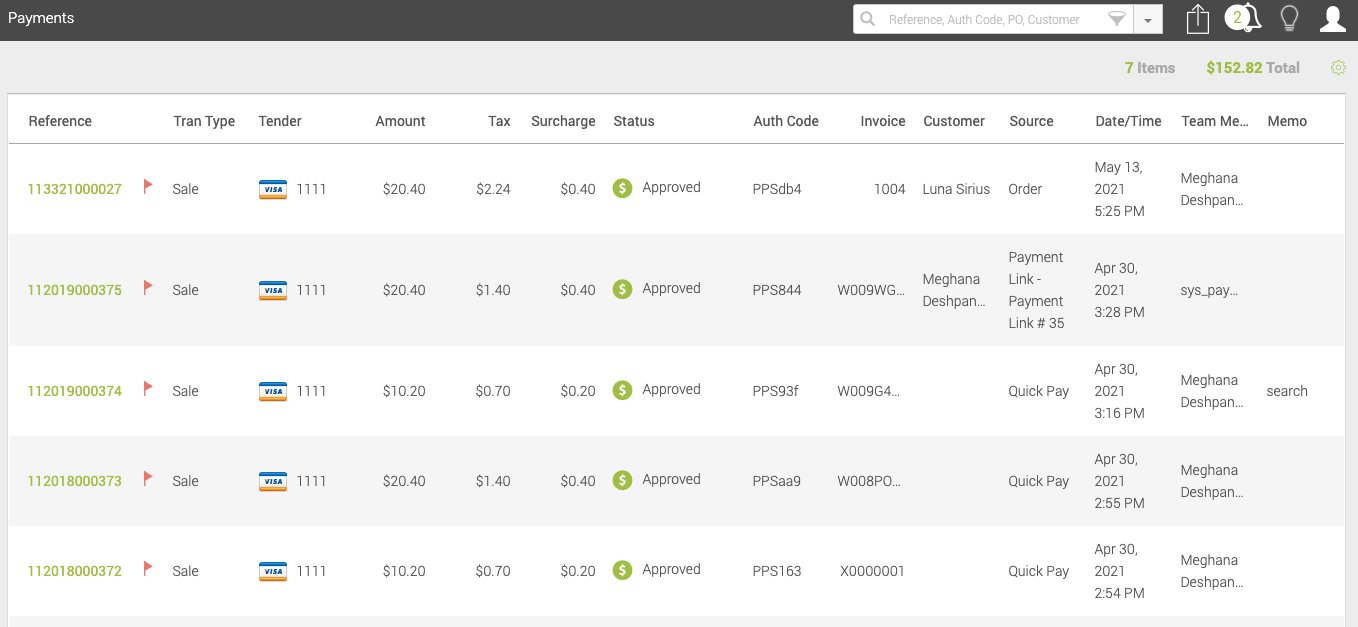

Where can I see the Surcharge fee charged for transactions?

The surcharge can be made visible on the Payment grid by clicking on the Settings and selecting "Surcharge". The columns in the grid can be rearranged as needed.

Settings on Payment grid page showing Surcharge as a separate column

Surcharge fee appearing as a separate column on the Payment grid

-

Can I change the description or descriptor that appears on a merchant’s statement for surcharge?

No. In order to maintain proper compliance with surcharging rules, the descriptor is hardcoded to “Surcharge” -

Where can I access more information?

Link to VISA Surcharging FAQ for merchants: https://usa.visa.com/dam/VCOM/download/merchants/surcharging-faq-by-merchants.pdf

Link to VISA Merchant Credit Surcharging: http://www.visa.com/merchantsurcharging -

Now that I know how surcharging works, what makes this program different from a convenience fee, a service fee, or cash discount solutions?

We’re so glad you asked! Soon, the MX Advantage business suite will provide a one-stop-shop of resources for fee-based and Cash Discount solutions. MX Advantage will comprise four categories; Convenience Fee, Service Fee, Surcharge, and Cash Discount. Each of these solutions works differently according to Card Brand rules so we wanted to provide you with a little insight into each below.

Convenience Fees may be charged only to a transaction completed in a Card-Absent Environment. The Convenience Fee is implemented via a flat or fixed amount (not a percentage) that may be imposed on all forms of payment when a payee is using an alternative payment channel that is different from the merchant’s normal payment acceptance channel. As an example, a merchant selling movie tickets may offer the convenience of purchasing tickets online as opposed to in person at the box office. This Convenience Fee must be clearly disclosed, before the completion of the transaction, and represent payment for the convenience of paying through an alternate payment channel (such as online) that is different from the merchant's normal payment channel.

Service Fees may be a fixed amount or percent, regardless of the value of the payment due and can be charged in both Face-to-Face Environment and a Card-Absent Environment. A service fee may be implemented by merchants in the following Merchant Categorie: 8211 - Elementary & Secondary Schools, 8220 - Colleges, Universities, Professional Schools, and Junior Colleges, 9311 – Taxes, 9211 - Court Costs, 9222 – Fines, 9399 - Misc Government Services, 8244- Business and Secretarial Schools, and 8249- Vocational and Trade Schools.

Cash Discount differs slightly from the above models and instead of being a fee-based product, it offers a discount for paying in cash, however, the discount must be given as a reduction from the stated or standard price. Merchants may request or encourage a cardholder to use a means of payment other than a Credit Card, the method of doing so must be permitted under the Association rules, such as offering a discount from the merchant's list, stated or standard price, among other possible incentives.

Non-Cash Adjustment may be charged to credit and debit cards only at a percentage rate with a 4% cap.

- For more information on rules relating to service, surcharge and convenience fees, click here: Surcharging Credit Cards–Q&A for Merchants: https://usa.visa.com/support/consumer/visa-rules.html

- Visa Core Rules: https://usa.visa.com/dam/VCOM/download/about-visa/visa-rules-public.pdf

- Visa Merchant Surcharging Rules: https://usa.visa.com/support/small-business/regulations-fees.html

Updated almost 3 years ago